Companies are tying themselves in knots trying to figure out how to best leverage Facebook for driving customer engagement. The core obstacle, of course, is that Facebook is ultimately a network designed for connecting friends, not customers.

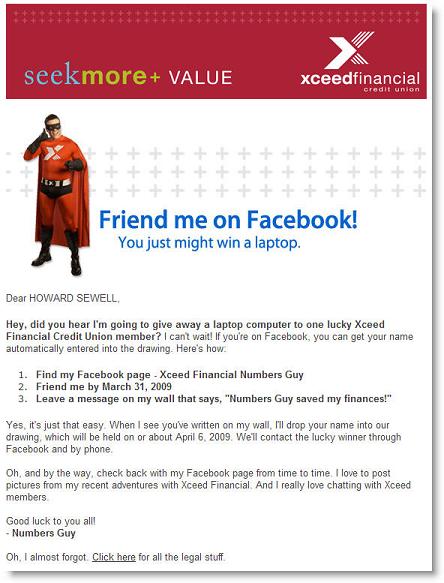

Here’s an example of one organization, a credit union, trying their darndest to negotiate their way around the Facebook marketing conundrum. Personally, as a consumer and a member of this particular credit union, I feel the campaign fell flat. Professionally, as a direct marketer, however, I’m conflicted.

On the one hand, you have to admire the novelty of the approach. “Hey, if Facebook is about connecting people, let’s make our company a person!” On the other hand, I’m left wondering why anyone would friend this individual, besides the chance of winning a laptop. Plus, do I really want to be seen befriending a credit union, never mind a character named “Numbers Guy”? I recognize that when you join Facebook you check your self-respect at the door, but even then, this seems like asking a lot.

On the one hand, you have to admire the novelty of the approach. “Hey, if Facebook is about connecting people, let’s make our company a person!” On the other hand, I’m left wondering why anyone would friend this individual, besides the chance of winning a laptop. Plus, do I really want to be seen befriending a credit union, never mind a character named “Numbers Guy”? I recognize that when you join Facebook you check your self-respect at the door, but even then, this seems like asking a lot.

Moreover, a credit union is a community, much more so than a bank or most other companies or institutions you do business with. My question is: Why bother with Numbers Guy at all? Why not simply create a group for credit union members, fans or otherwise? Instead of the gimmickry, make the Facebook group a gathering place, a forum, a place to ask questions and share information. Make the benefits of joining the group genuine and information-driven (“Be amongst the first to learn about mortgage rates, promotions, and special offers …”) Wouldn’t that be more compelling?

What do you think? Comments welcome.

Howard, I too commend the credit union for trying something different. At the same time, with all due respect to those who thought this up — “trying something different” should not mean “insult your prospective customer’s intelligence.”

I.e., they’re trying to get you to recommend them (“Numbers Guy saved my finances!”) without having first given the kind of useful information and resources that you suggest…information and resources that would be necessary for someone to sincerely make a statement like this.

Compounding the problem, it’s not like asking someone to recommend a restaurant or a movie — there are few matters more personal than one’s finances.

Of course, paid endorsements are nothing new (!), and if that’s the credit union’s objective — okay, no problem. Because that’s what this really is. But if they expect people to perceive otherwise…